Australia Travel Insurance: Peace of Mind for Your Journey

Understanding Trip Insurance in Australia

Traveling to Australia offers a rich tapestry of experiences, from the vibrant cityscapes of Sydney and Melbourne to the serene beauty of the Great Barrier Reef and the rugged outback. However, as with any travel plan, the unexpected can happen. This is where trip insurance Australia comes into play, providing travelers with peace of mind and financial protection against unforeseen events.

Trip insurance Australia is designed to cover a range of potential issues that can arise during your travels. Whether it’s a medical emergency, trip cancellation, or lost luggage, having the right insurance policy can save you from significant expenses and stress. For instance, medical costs in Australia can be quite high for tourists, and without proper coverage, a sudden illness or accident could lead to substantial out-of-pocket expenses.

Moreover, trip cancellations due to unforeseen circumstances such as illness, natural disasters, or even political unrest can be financially crippling. Trip insurance Australia typically covers these scenarios, ensuring that you are reimbursed for non-refundable travel expenses. This protection allows you to plan your itinerary with confidence, knowing that your investment is safeguarded.

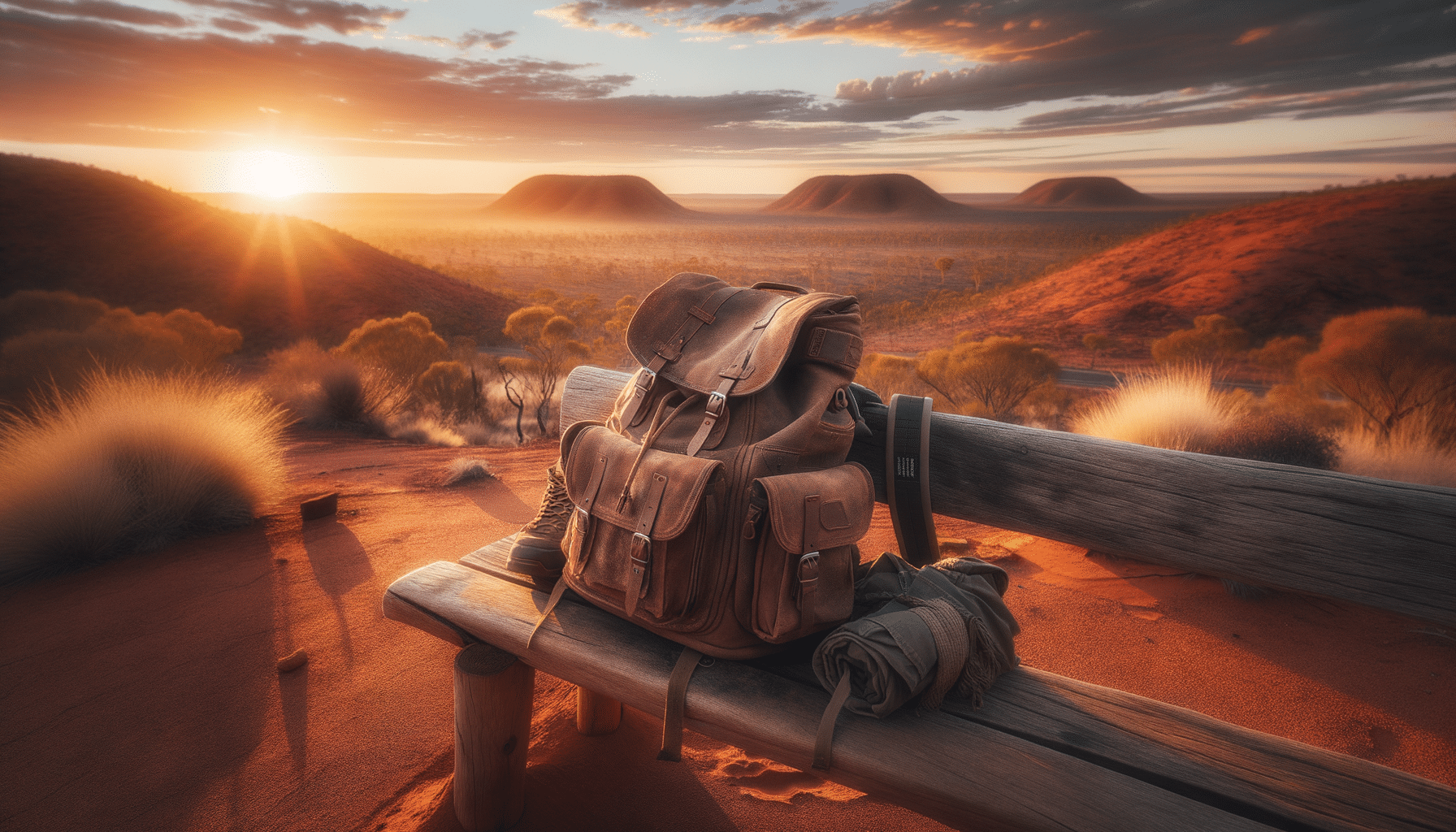

When selecting a policy, it’s crucial to read the fine print and understand what is covered. Different policies offer varying levels of protection, so consider your travel plans and any potential risks. For adventure seekers exploring the outback or diving the Great Barrier Reef, ensure your policy covers such activities. Additionally, consider any pre-existing medical conditions, as these may require special coverage.

Key Benefits of Trip Insurance Australia

Trip insurance Australia offers several key benefits that cater to the diverse needs of travelers. One of the most significant is medical coverage. Australia is known for its high-quality healthcare, but for visitors, treatment can be costly. Insurance can cover medical expenses, including hospital stays, doctor visits, and even emergency medical evacuation if necessary.

Another vital aspect is trip cancellation and interruption coverage. This feature ensures that if your trip is disrupted due to reasons like illness, injury, or unforeseen events, you can recover non-refundable costs. This is particularly important for travelers who book flights, accommodations, and tours in advance, as these expenses can add up quickly.

Luggage protection is another benefit worth considering. Losing your luggage or having it delayed can be a major inconvenience, especially if it contains essential items for your trip. With trip insurance Australia, you can receive compensation for lost or delayed baggage, allowing you to replace necessary items without financial strain.

Additionally, trip insurance often includes coverage for personal liability, which can protect you if you accidentally cause damage to property or injury to another person. This aspect provides an extra layer of security, particularly for those engaging in activities that carry a higher risk of accidents.

Ultimately, trip insurance Australia is about providing travelers with a safety net. It allows you to focus on enjoying your journey, knowing that you have support in place should any issues arise. Whether you’re exploring the bustling cities, relaxing on pristine beaches, or adventuring in the outback, having comprehensive coverage ensures peace of mind throughout your travels.

Choosing the Right Trip Insurance Policy

When it comes to selecting a trip insurance Australia policy, there are several factors to consider to ensure you choose the right coverage for your needs. First and foremost, assess the kind of trip you’re planning. Are you going on a short city break, or are you embarking on a month-long exploration of Australia’s diverse landscapes? The nature and duration of your trip will significantly influence the type of insurance you require.

Next, consider the activities you plan to engage in. If you’re an adventure enthusiast planning to dive, surf, or hike in remote areas, ensure your policy covers such activities. Some insurers offer specialized coverage options for adventure sports, which can be crucial in providing adequate protection.

It’s also important to evaluate the insurance provider’s reputation. Look for companies that are well-regarded in the industry and have a track record of reliable customer service. Reading reviews and seeking recommendations can help you gauge the experiences of other travelers and make an informed decision.

Another critical factor is the policy’s cost versus coverage. While it’s tempting to opt for the cheapest option, ensure that the policy offers comprehensive protection. Compare the benefits offered by different insurers, including the maximum coverage limits and any exclusions that might affect your decision.

Finally, consider any additional features that may be important to you, such as 24/7 emergency assistance, which can be invaluable in a crisis. Having access to a support team that can provide guidance and help coordinate services can make a significant difference in managing unexpected situations abroad.

By carefully evaluating these factors, you can choose a trip insurance Australia policy that aligns with your travel plans and provides the level of security you desire. This thoughtful approach ensures that you are well-prepared for your journey, no matter where your adventures take you.

Common Misconceptions About Trip Insurance

Despite its importance, trip insurance Australia is often misunderstood, with several misconceptions deterring travelers from purchasing coverage. One common myth is that insurance is unnecessary if you have a credit card with travel benefits. While some credit cards offer travel perks, they are not a substitute for comprehensive trip insurance, which provides broader protection and higher coverage limits.

Another misconception is that trip insurance is too expensive, deterring budget-conscious travelers. However, the cost of insurance is relatively small compared to the potential financial burden of an unexpected event. The peace of mind that comes with knowing you’re covered in case of emergencies is well worth the investment.

Some travelers also believe that trip insurance is only necessary for long or international trips. In reality, even domestic travel within Australia can benefit from insurance, especially if you have pre-paid for flights, accommodations, and activities. Trip insurance can protect these investments, ensuring that you are not left out of pocket if plans change unexpectedly.

Additionally, many assume that pre-existing medical conditions are not covered, which can discourage those with health concerns from purchasing insurance. While some policies may exclude these conditions, others offer coverage if the condition is stable or if additional premiums are paid. It’s crucial to disclose any health issues to the insurer to ensure you receive the appropriate coverage.

By understanding and debunking these misconceptions, travelers can make informed decisions about trip insurance Australia. Recognizing the true value and comprehensive protection it offers encourages more individuals to prioritize their safety and financial security while exploring this beautiful country.

Making the Most of Your Trip Insurance

To maximize the benefits of your trip insurance Australia, it’s essential to be proactive and informed. Before embarking on your journey, take the time to thoroughly read your policy document. Understanding the terms and conditions, including coverage limits and exclusions, ensures that you are fully aware of what is covered and how to make a claim if necessary.

Keep a copy of your insurance policy and emergency contact numbers readily accessible during your travels. In the event of an emergency, having this information on hand allows you to quickly reach out for assistance and expedite the claims process.

Documentation is key when it comes to making a claim. In cases of lost luggage or trip cancellations, ensure you retain all relevant receipts, tickets, and correspondence with service providers. This documentation serves as evidence and supports your claim, increasing the likelihood of a swift resolution.

It’s also advisable to contact your insurer as soon as an issue arises. Prompt communication allows the insurer to provide guidance on the next steps and ensures that you follow the correct procedures for making a claim. Many insurers offer 24/7 helplines, providing immediate support no matter where you are in the world.

By taking these proactive steps, you can make the most of your trip insurance Australia and enjoy your travels with confidence. Having the right coverage allows you to focus on creating unforgettable memories, knowing that you are protected against the unexpected.